WHEN TOO MUCH MONEY IS A BAD THING: THE RIPPLE EFFECTS OF ASSET BUBBLES

"When the capital development of a country becomes a by-product of the activities of a casino, the job is likely to be ill-done." - John Maynard Keynes

John Maynard Keynes warned about the risks of investing in things that might not work out and not investing enough in industries that make useful things. In this article, you'll discover the historical precedent that has been set when money gets injected too quickly into the economy.

Keynes thought that greed for quick profits often drives people to engage in speculation instead of focusing on long-term growth and stability. He warned that this kind of behavior could cause financial instability and bubbles in the market, as investors become overly optimistic about their returns.

This type of speculation can occur when money is injected into the economy too quickly. When the money supply grows too quickly, it can lead to asset bubbles and financial instability, as seen in several examples from US history.

The Roaring Twenties and the Stock Market Crash of 1929

One of the most famous examples of excessive money supply growth leading to an asset bubble and financial crisis is the stock market crash of 1929. In the 1920s, the US economy was booming, with a surge in industrial production and consumer spending. The Federal Reserve, the central bank of the US, pursued a loose monetary policy during this time, keeping interest rates low and increasing the money supply to stimulate economic growth.

This loose monetary policy helped fuel a stock market bubble, as investors poured money into the market in the hopes of making quick profits. Stock prices soared to unsustainable levels, and many companies that were not profitable on paper saw their stock prices rise sharply.

However, in October 1929, the stock market crashed, wiping out many investors' fortunes and leading to a prolonged economic downturn known as the Great Depression. The bursting of the stock market bubble contributed to the severity of the Depression, which lasted for over a decade and caused widespread unemployment and hardship.

The Dot-Com Bubble of the Late 1990s and Early 2000s

Another example of excessive money supply growth creating an asset bubble and financial instability is the dot-com bubble of the late 1990s and early 2000s. During this time, the internet was emerging as a powerful force in the economy, and many investors saw huge potential in internet-related stocks.

The Federal Reserve once again pursued a loose monetary policy during this time, keeping interest rates low and increasing the money supply to promote economic growth. This policy helped fuel a stock market bubble, as investors poured money into internet-related companies regardless of their actual profitability.

However, in the early 2000s, the dot-com bubble burst, and many of these companies went bankrupt. The burst of the bubble led to a mild recession and highlighted the dangers of excessive speculation and loose monetary policy.

The Housing Market Boom and Subsequent Financial Crisis of the 2000s

Perhaps the most recent example of excessive money supply growth creating an asset bubble and financial instability is the housing market boom of the 2000s. During this time, there was a surge in demand for housing and mortgages, and many people who could not previously afford homes were able to take out loans.

The Federal Reserve once again pursued a loose monetary policy during this time, keeping interest rates low and increasing the money supply to promote economic growth. This policy helped fuel a housing market bubble, as banks and other lenders made risky loans to people who could not afford them.

However, in 2007 and 2008, the housing market bubble burst, leading to a financial crisis that had global implications. Many of the loans made during the housing market boom went into default, leading to a wave of foreclosures and bankruptcies. The financial system itself was also severely affected, as many banks and other financial institutions held large amounts of toxic mortgage debt.

Bear Market Rallies

It's important to keep in mind that during these bear markets there were significant movements that looked like maybe the bear market was ending. There were five separate bear market rallies that were selling opportunities during the 1929-32 decline. [1]

- After the stock market crash in November 1929, the stock market went up by 47% from the lows in November to the highs in March 1930. But then the market went down again, by almost 46%, from that secondary peak.

- Another rally started in December 1930 and ended in March 1931, with a gain of almost 24%. But then the market declined by 38% into June 1931.

- The third rally was very short, but stocks went up by 29% until July 1931. Then another major sell-off brought stocks down by 45% into October 1931.

- During the fourth rally, stocks gained 38% until November. But then they went down again by 42% until January 1932.

- The fifth and final rally moved stocks up by 32% until May 1932. But from that point, the stock market declined again until July 1932, with the DJIA down 55%.

When the dot-com bubble began to burst around March of 2000, the market (particularly the tech-heavy Nasdaq Composite Index) declined for over two years before entering bull territory in late 2002. Over the course of this bear market, the Nasdaq Composite saw eight rallies of 15% or more, and the S&P 500 saw eight rallies of 5% or more before the market eventually reached its true bottom in the summer of 2002.

Starting in October 2007 and ending in March 2009, there was a bear market because of problems with subprime mortgages. During these 17 months, the S&P went down by around 57%, but it didn't go down all at once. There were 12 times when the market went up by 5% to 24% even though it was still a bear market. Finally, the market hit its real lowest point. [2]

Conclusion

The duration of asset bubbles varies, and it's difficult to give a specific time frame. However, in general, asset bubbles tend to last until the market realizes that asset prices have become detached from their underlying fundamentals. When this happens, investors begin to sell off their holdings, causing prices to drop sharply.

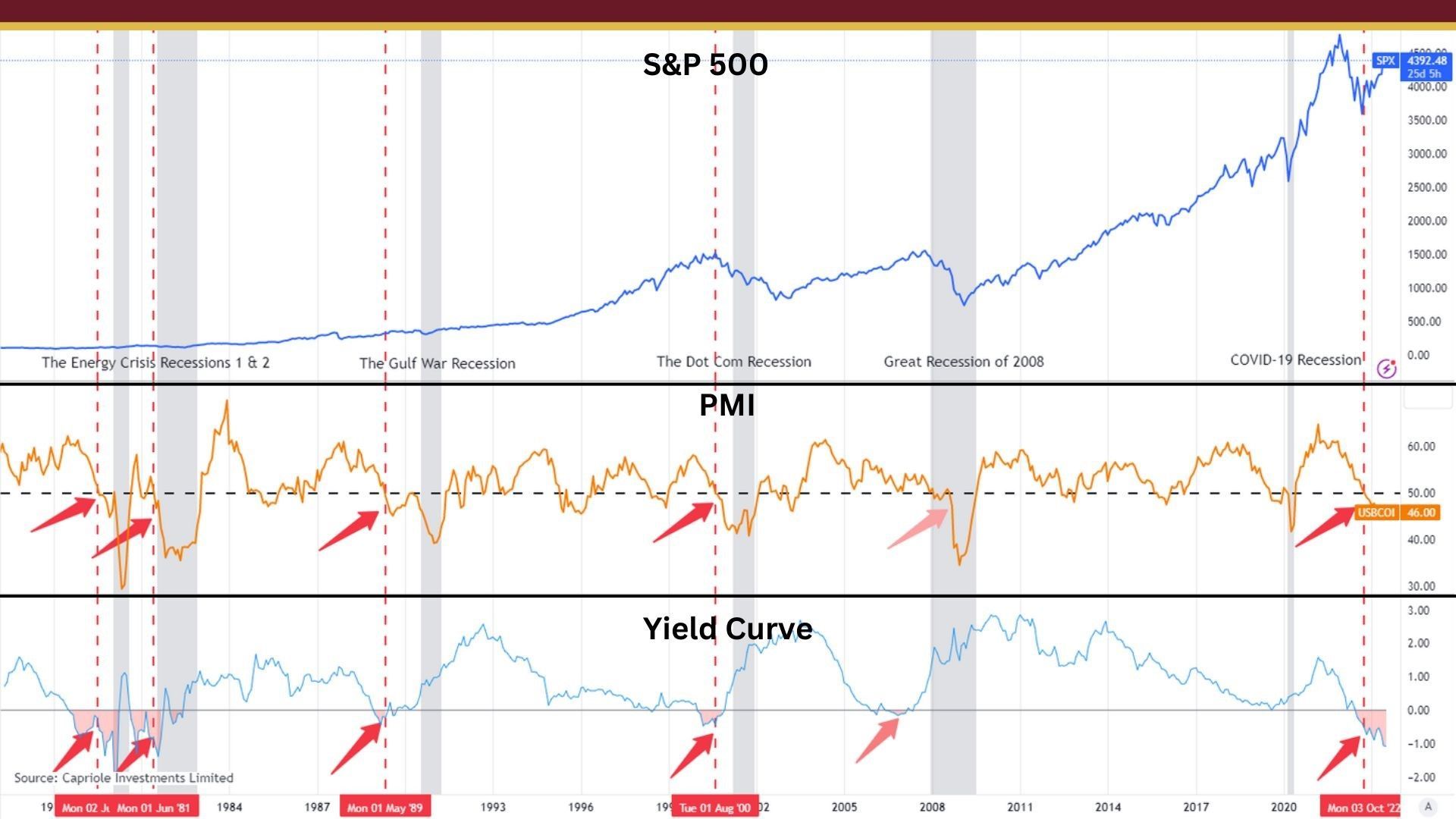

In conclusion, there are a lot of parallels between these three examples from US history and the current markets and economy. The large sums of money that were quickly injected into the economy following the months of the COVID lockdowns seemed to lead to large amounts of speculation into higher risk investments as interest rates remained low. Essentially setting the stage for a difficult bear market.

Unfortunately, there is not a crystal ball to what will come next. Yet, these three examples demonstrate the dangers of what can follow when high amounts of cash get injected into an economy with low interest rates. In each case, the Federal Reserve pursued policies designed to promote economic growth, but these policies also created asset bubbles and financial instability. The bursting of these bubbles led to economic downturns and had far-reaching consequences for the broader economy.

In spite of the aggressive increase of interest rates, the FED's most recent comments suggest that there is a long way to go in this fight against inflation. Essentially, the only way to bring inflation down is to decrease the amount of demand for goods and services. With a basic understanding of economics, you know that the price of a good or service will go down when demand goes down.

Essentially, the way to reduce demand is by reducing the amount of money that is available to be used on goods and services. One way this happens is by increasing interest rates because borrowing money at higher interest rates is less attractive. Another way money supply gets suppressed is through an increase of unemployment because people can’t spend money that they don’t earn.

In our estimation, there will most likely be a domino effect. If the FED continues to increase interest rates it should naturally decrease demand for goods and services. As demand falls businesses will have a fall off in revenue and look to cut costs. Employees are usually the largest cost in a business. So, if this happens, we should expect to see an increase of unemployment in the coming months.

At Abundance, our goal is to create an investment product that is adaptable to any market conditions. If the recent market gains are a "bear rally" we want to avoid chasing gains and be positioned for success over the long term.

Sources:

[1] https://us.tradezero.co/blog/the-bear-growls-for-thursday-the-1929-1932-model-90-year-cycle/783/

[2] https://www.thestreet.com/dictionary/b/bear-market-rally

Schedule a Discovery Call