TRACKING THE WORLD'S ECONOMIC HEALTH: PMI AND GLOBAL ECONOMIC INDICATORS

In February 2023, S&P Global released its report on the state of the global manufacturing sector. The report provides important insights into the performance of the manufacturing industry, which is a crucial component of the global economy. In this post, we will explore the key highlights from the global manufacturing data, highlighting the trends and patterns that are shaping the world economy.

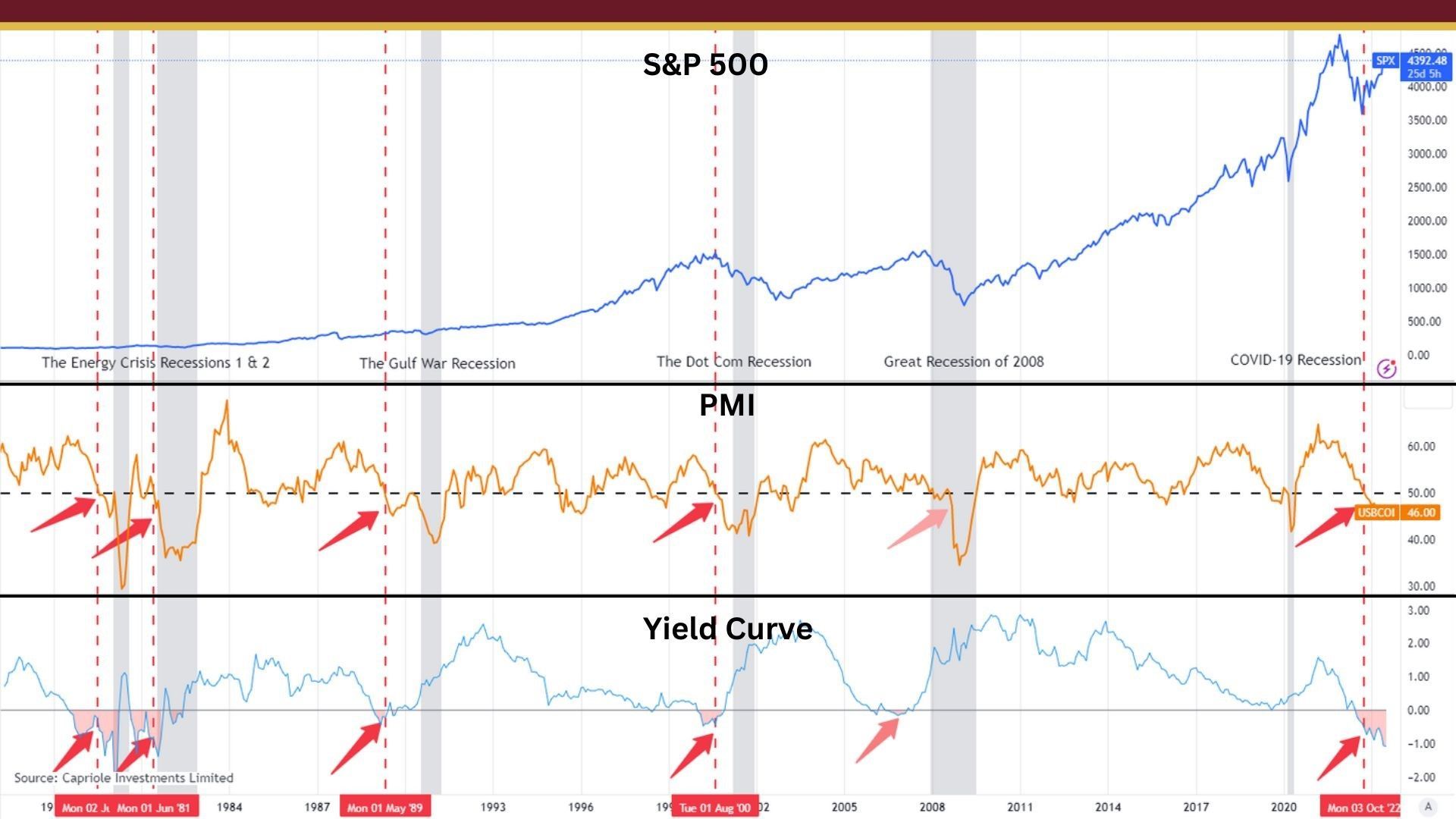

According to the report, the S&P Global Manufacturing PMI was 50.8 in February 2023. [1] This is the first time the global number has been above 50 since June of 2022. Why is it so important to be above 50? 50 is the threshold that differentiates between contraction and expansion.

Simply put: above 50 is a sign of growth and below 50 could point to signs of decline.

What is PMI and why does it matter?

Economists watch PMI (Purchasing Managers' Index) as an important factor of economic growth because it provides valuable insights into the health and direction of the manufacturing sector. The manufacturing sector is a crucial component of the economy, and its performance is closely linked to overall economic growth. The PMI is an indicator of the health of the manufacturing sector and is based on a survey of purchasing managers in the sector.

The PMI provides a timely and reliable assessment of manufacturing activity, as it is released on a monthly basis. It measures a range of factors, such as new orders, production, employment, and supplier delivery times, and is used to gauge the level of business activity and confidence in the sector.

Since the manufacturing sector is closely linked to other sectors of the economy, such as transportation, construction, and retail, the PMI is often used as a way to forecast economic growth. If the manufacturing sector is expanding, this can lead to increased business activity, employment, and consumer spending, which can drive economic growth. Conversely, if the manufacturing sector is contracting, this can lead to decreased business activity, employment, and consumer spending, which can lead to a slowdown or recession.

February PMI Data Around The World

The report also provides insights into the performance of individual countries and regions. Here are some of the key findings:

United States: The S&P Global Manufacturing PMI for the US was 47.3 in February 2023, slightly up from 46.9 in January 2023. Besides the supply chain disruption that occurred during COVID, this continues to signal one of the steepest downturns since 2009. [2]

The report showed that manufacturing activity went down for the fourth month in a row, but not as fast as before. This happened because companies had fewer orders from customers both in their own country and in other countries. As a result, they spent less money and reduced the amount of things they had in stock. However, this meant that suppliers were able to deliver goods faster than they have been able to in many years. Companies hired more people to help them catch up with the work they had to do. Prices went up because companies were spending more money, but it was not as much as they had been spending before.

China: The S&P Global Manufacturing PMI for China was 52.6 in February 2023, up from 50.1 in January 2023. This indicates that the sector is still expanding, although at a slightly slower pace than in the previous month. [3]

Eurozone: The S&P Global Manufacturing PMI for the eurozone was 48.5 in February 2023, down from 49.8 in January 2023 and the eighth straight month of falling factory activity. [4]

The amount of things being made, new orders, and jobs available in the manufacturing industry were all positive. The amount of things being made stayed the same and did not go down for the first time in eight months. The cost of getting the things they need to make products went down considerably, and the prices of things people buy did not go up very much.

Japan: The S&P Global Manufacturing PMI for Japan was 47.7 in February 2023, down from 48.9 in January 2023. This is the fourth time in a row that things are getting worse for the manufacturing industry in Japan. The amount of things being made and the number of orders for new things have gone down the most in over two-and-a-half years. Also, the amount of orders from other countries has gone down substantially, which has been happening for a whole year. [5]

United Kingdom: The S&P Global Manufacturing PMI for the UK was 49.4 in February 2023, up from 49.2 in January 2023. [6] This is the smallest decline in seven months. Things were not going well for some time, but now they are starting to get better. Companies are making more things again because people want to buy them, and they are able to get the materials they need more easily. Even though not as many new orders are coming in, the prices of things are not going up as quickly as before. Companies are also able to get the things they need to make their products more quickly than before. However, they are still not hiring very many new workers.

Moving Forward

Asia saw the biggest increase in manufacturing, and Thailand, India, and the Philippines were the countries with the most growth for the second month in a row. Indonesia also did well, and both China and Vietnam started growing again. Overall, manufacturing around the world is improving. However, North America had the weakest manufacturing growth, with production dropping for a fourth month. The US had a hard time, but Canada and Mexico did better.

This is not ideal. Many companies are having trouble selling their products, which is causing a decrease in new orders. This may be because companies are trying to save money by reducing their inventory, and their customers are not feeling confident about spending money.

In short: This is not a good sign for the US economy.

Our goal is to help you navigate through different market conditions and make sound investment decisions. Whether you're a seasoned investor or just starting, we're here to guide you every step of the way. Don't hesitate to contact us today to learn more about how we can help you achieve your financial goals.

Citations:

[4] https://www.pmi.spglobal.com/Public/Home/PressRelease/5bfa7b6357b84861bdedcda9624e8447

[6] https://tradingeconomics.com/united-kingdom/manufacturing-pmi

Schedule a Discovery Call