BANKING ON SHAKY GROUND: UNDERSTANDING THE CAUSES AND CONSEQUENCES OF THE RECENT BANK FAILURES

The recent bank failures have been a cause of concern for many investors and market analysts. The impact of these failures on the financial markets is still to be determined. While some believe that the failures will have a limited impact on the markets, others are predicting a significant ripple effect that could have far-reaching consequences. In this article, we will explore the recent bank failures, their underlying causes, and the potential impacts on the financial markets.

Why Banks Fail

Banks can sometimes fail when the money they have isn't worth as much as the money they owe to other people. This is tracked on a company’s balance sheet in terms of assets and liabilities. Essentially, failure can happen when a bank's liabilities are greater than their assets. Ultimately, this occurs when banks make poor choices with their money.

When you put your money in a bank, the bank uses it in different ways. First, they keep some in reserves so they can satisfy requests from clients who need to take money out of their accounts. Second, banks lend most of it to other people who need money. They charge interest on these loans, which helps the bank make money. Third, they might invest some of the money in the stock market or other places where they can make even more money. Finally, they use some of the money to pay for things like rent and salaries.

Therefore, a bank gets into trouble when they don't have enough money to meet withdrawal requests from clients. When this happens, it might try to borrow money from other banks that are still doing well. This is so it can give money back to the people who trusted it with their savings.

But if the bank can't pay those people, they might all get scared and try to take their money out at once. This is called a "bank panic." It can make things even worse for the bank that's already struggling, because it will have less money left over when everyone takes their cash out.

Silicon Valley Bank Failure

This is where Silicon Valley Bank (SVB) found itself recently. SVB was the premier place for new business startups and their investors. The bank had more than $200 billion in deposits in early 2022, which is no small feat. However, some of that money was more than the amount that is protected by the government through FDIC insurance. To handle all that extra money, SVB invested most of it in U.S. Treasury and government-backed mortgage securities with a fixed interest rate.

Essentially, these investments are making loans to the government, and the investment sets a fixed interest rate and time duration on the investment. For SVB, they were holding 10 year treasury bonds that were yielding on average 1.79% interest annually.[2]

Historically, these investments are low risk and as long as they held the bond for the full 10 years they would recoup their initial investment along with all the interest payments. Risk can creep in if you're forced to sell these bonds before the time frame that is designated by the investment (…in this case, 10 years for SVB).

In a nut shell, due to the current struggles in the economy, many of SVBs clients were requesting to make withdrawals. In order to meet the requests, SVB had to start selling their US Treasury and government back mortgage investments before the full term of the investment.

This created a huge loss for the bank because the value of these investments will decrease when interest rates rise. So, the average 1.79% interest rate of their 10-year Treasury bonds was well below the current yield in the market that is over 3%. This caused SVB to recognize a $1.8 billion loss.

That’s billion with a "B".

At that point the writing was on the wall. Once investors and clients heard about the large loss they were concerned and were prompted to get their money out of the bank...which SVB couldn't handle. In the following days, we've seen other banks show signs of struggling and failure.

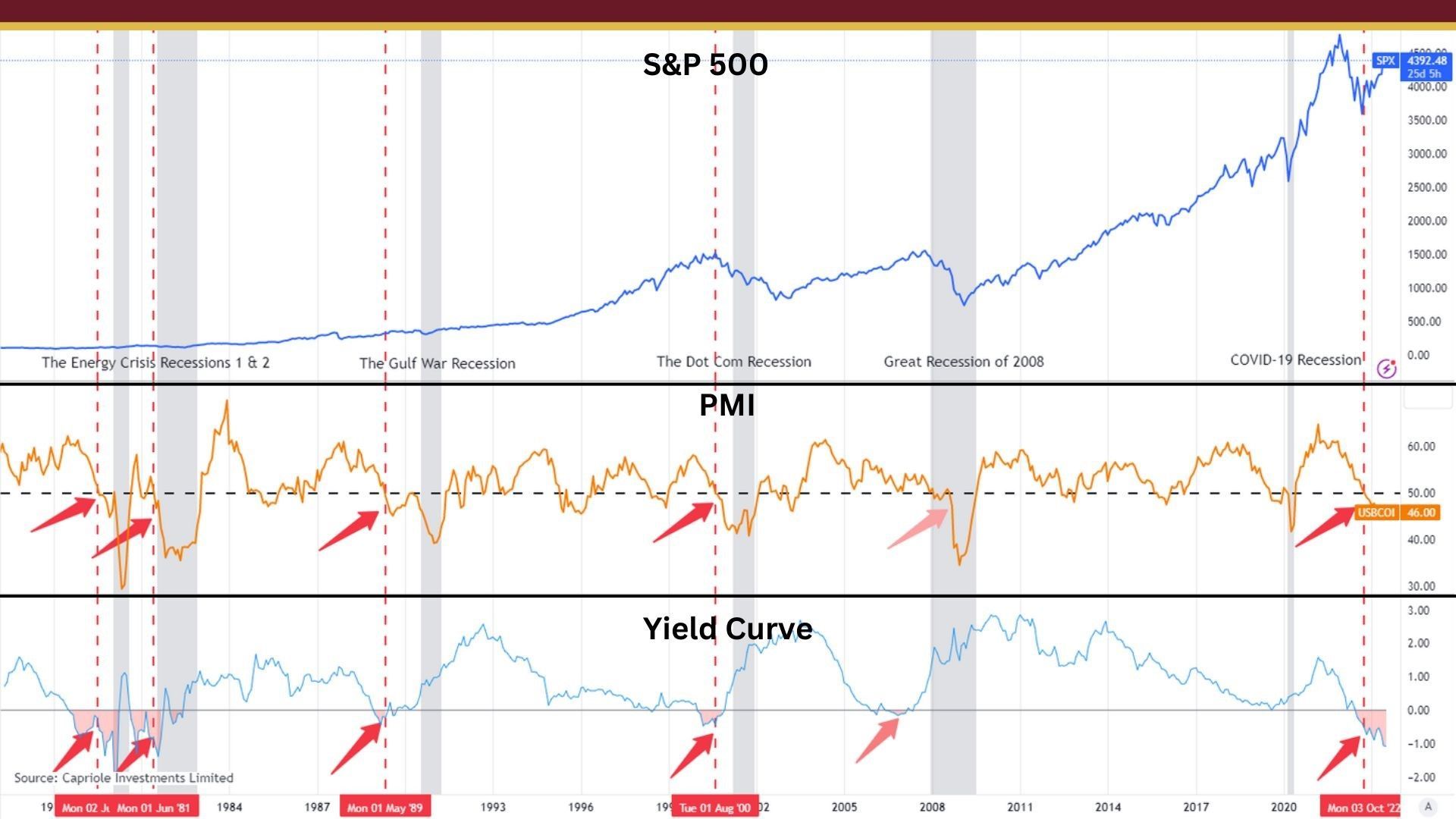

Is This A Repeat of 2008?

In 2008, a lot of banks failed because they made bad loans and didn't check if the people they were giving money to could pay it back. This was widespread in the industry and over 600 banks failed by the end of the Great Recession. The banking crisis today is different because it's less about making risk loans and more about poor money management.

They invested heavily into treasury bonds on the thought that interest rates would stay low, and didn't make a plan in case they were wrong. When inflation went up, interest rates went up too. By 2022, the banks lost a lot of money because the loans and bonds they invested in weren't worth as much.

Secondly, they operated under the assumption that their customers would always keep their money in the bank, even if they had more money than what the government usually protects. But when things got tough, the customers took their money out of the bank, which made things worse.

What's Next?

This creates a sticky situation for the FED to navigate. Inflation is still high and they have hinted at raising rates longer. Yet, these bank failures could be warning signs that the aggressive rate hikes have been too much and created cracks in the foundation. Many are calling for the FED to ease off the rate hikes in an effort to help make money and growth more accessible.

EJ Antoni is a research analyst with The Heritage Foundation’s Center for Data Analysis. He recently said, "The FDIC doesn’t have enough funds to cover these losses. If it did, the Federal Reserve would not have had to establish an emergency lending fund on a Sunday evening to backstop the operation. The Fed can simply create the money to cover the losses at these failed banks, which will cause inflation, or the FDIC can do what they did in the last financial crisis and simply get the money from the Treasury, which is a direct cost to taxpayers. Either the American people are on the hook through the hidden tax of inflation or explicit taxes sent to the Treasury." [3]

No one is clear on what will happen next, but we're not inclined to think that we're out of the woods regarding the bear market. The economy seems to be in a period of contraction and we anticipate that to become more evident as GDP numbers get released over the next couple of quarters.

Our goal is to create a portfolio that helps you meet your goals, and one of the best ways to do that is by creating a portfolio that is flexible when the market changes.

Sources:

- https://www.clarkhill.com/news-events/news/in-the-wake-of-the-demise-in-silicon-valley-bank-and-signature-bank-what-fintechs-private-equity-and-banks-need-to-know/

- https://www.reuters.com/business/finance/what-caused-silicon-valley-banks-failure-2023-03-10/

- https://www.foxbusiness.com/economy/biden-claim-that-silicon-valley-bank-bailout-wouldnt-cost-taxpayers-contradicts-fiscal-reality-economist

Schedule a Discovery Call