RESILIENCE AND VULNERABILITIES: DECODING THE GLOBAL ECONOMY'S STORY

Amidst upwardly revised GDP growth and declining jobless claims, underlying risks such as banks prioritizing financial stability and a decline in global manufacturing cast a shadow of uncertainty. In this week's update, we delve into crucial economic factors that are currently shaping the global landscape. By examining manufacturing PMI, banks' defensive stance, and the resilience observed in the US economy, we aim to provide valuable insights into the current state of affairs.

Manufacturing PMI and Recession Signals

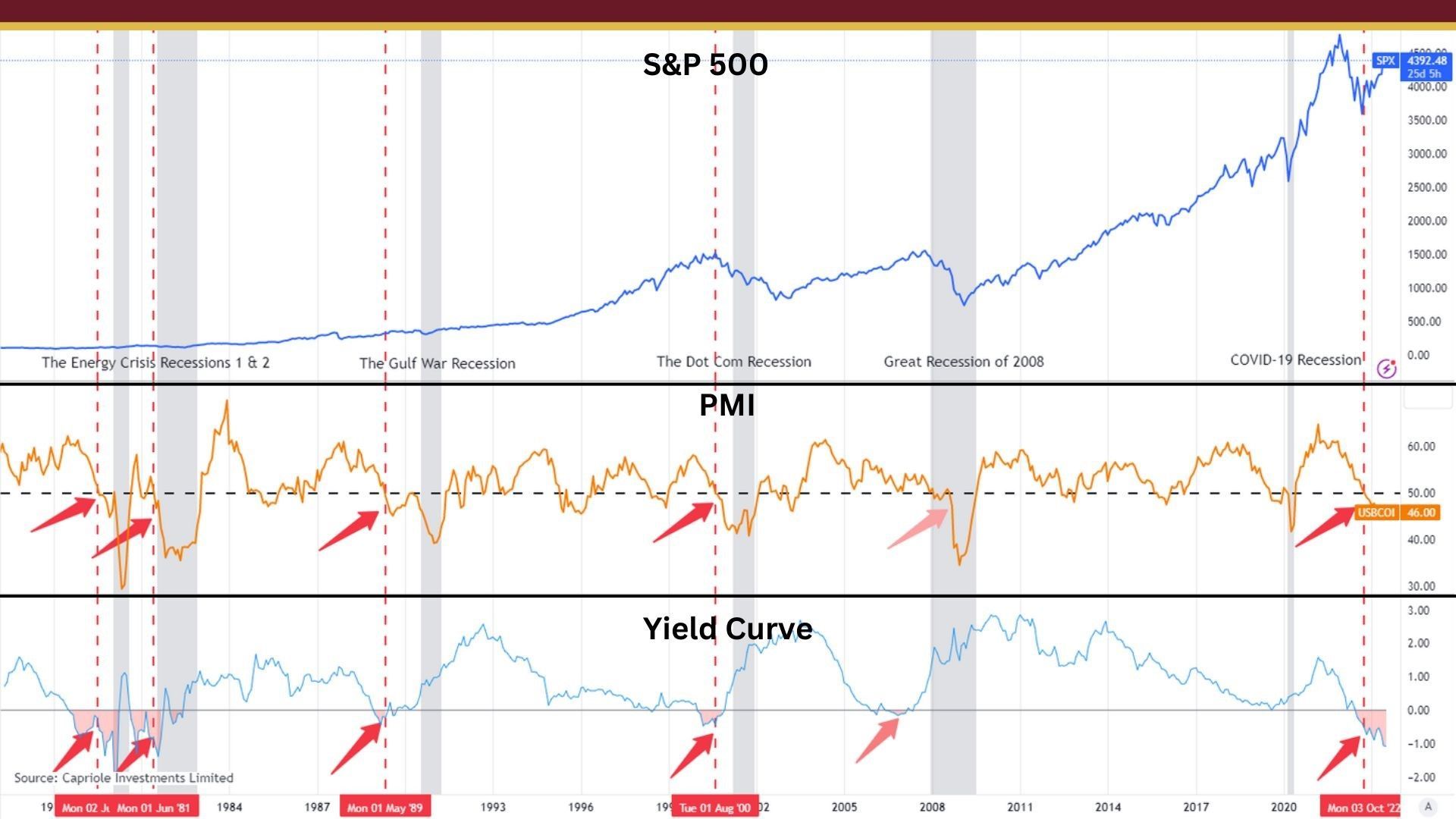

The S&P Global Flash US Manufacturing PMI™ is a widely recognized economic indicator that measures the performance of the manufacturing sector. In June 2023, the PMI dropped to 46.9 [1], raising concerns about a potential recession. The PMI measures the performance of the manufacturing sector based on surveys conducted among purchasing managers. It provides an overview of various aspects, including new orders, production levels, employment, supplier deliveries, and inventories. A reading above 50 indicates expansion, while a reading below 50 suggests contraction.

This decline from 51.0 in May marks the lowest reading since February 2020. The contraction in the manufacturing sector is primarily driven by a slowdown in new orders and production[1]. Manufacturing PMI is an important indicator as it reflects the overall economic health of a country. The slowdown in new orders and production can be influenced by various factors such as changes in consumer demand, supply chain disruptions, labor shortages, trade policies, and global economic conditions. However, in this instance, the largest contributors are a drop in consumer demand and global economic conditions.

Historically, there is a correlation between manufacturing PMI contractions and economic recessions. For instance, during the global financial crisis of 2008-2009, the PMI readings dropped significantly, signaling an economic downturn. Similarly, the PMI contraction in 2020 preceded the economic recession triggered by the COVID-19 pandemic. This makes it an important signal for investors and businesses to monitor [1].

Defensive Posture of Banks Worldwide

Banks worldwide have been adopting a defensive posture, which further signals potential trouble ahead [2]. A defensive posture means that banks are taking measures to mitigate potential risks and ensure financial stability. Specific actions can include increasing capital reserves, tightening lending standards, reducing exposure to high-risk assets, enhancing risk management practices, and diversifying their portfolios to minimize vulnerabilities.

The cautious approach of banks reflects their awareness of potential risks in the economy. By adopting a defensive posture, banks aim to protect themselves from financial shocks, economic downturns, and uncertainties. This cautious approach contributes to overall economic stability by reducing the likelihood of systemic risks and enhancing the resilience of the financial system. When banks take this defensive posture, it becomes a greater priority to be fiscally stable than make loans - which are the main revenue source for banks.

In my opinion, this is something to watch as many commerical real estate loans come due in the next 12-18 months. As interest rates have significantly increased over the past 12 months, it will be challenging for businesses to renew those loans which will negatively impact the banks and their revenue [3].

Signs of Resilience in the US Economy

Despite concerns highlighted by manufacturing PMI numbers and the defensive posture of banks, positive news emerges from the US economy. First-quarter GDP growth has been revised up to 2.0% from 1.3% [4], indicating ongoing economic expansion. The revision of first-quarter GDP growth from 1.3% to 2.0% indicates that the US economy is expanding at a slightly faster pace than previously estimated. This upward revision suggests stronger economic performance and reflects positive momentum.

Additionally, weekly jobless claims in the United States fell to their lowest level since October 2021 [4]. The decline in jobless claims to their lowest level since October 2021 signifies a that the labor market is showing signs of resilience. In previous weeks we've discussed the impact of labor hoarding and how it could be affecting these weekly numbers.

The revised GDP growth and the decline in jobless claims reflect the resilience of the US economy. However, it is important to note that the economy is growing at a slower pace compared to previous quarters [4]. The Federal Reserve's efforts to combat inflation may influence future economic growth. While positive indicators exist, rising inflation and external factors such as the war in Ukraine could impact the possibility of a future recession [4].

Conclusion

In summary, considering the manufacturing PMI numbers, the defensive stance of banks, and the positive indicators in the US economy, the outlook for the next 6-12 months remains uncertain as we are getting mixed signals across the global economy. There are some encouraging signs for the US economy as the labor market appears to be resilient. However, there's an undertone of vulnerability that warns of potential risks that could lead to a sharper downturn if not carefully managed. Our Directional Portfolios aim to build a portfolio that will adjust with the business cycle. If you'd like to learn more, you can call or text at 678.884.8841 or email us at connect@findabundance.com.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Sources:

- https://www.pmi.spglobal.com/Public/Home/PressRelease/6e8efbfbddde43f29eb12c5193939625

- https://www.ecb.europa.eu/press/key/date/2023/html/ecb.sp230302~41273ad467.en.html

- https://fortune.com/2023/06/26/commercial-real-estate-office-downturn-outlook-goldman-sachs-morgan-stanley-ubs-pwc-bofa/

- https://www.reuters.com/markets/us/us-weekly-jobless-claims-fall-first-quarter-gdp-revised-higher-2023-06-29/

Schedule a Discovery Call

Schedule a Consultation

We will get back to you as soon as possible.

Please try again later.

VISIT US

Stop by and see us at the historic, Nowell-Wheeler House.

(Parking is available behind the building and along Williams Street)

248 North Broad Street

Monroe, GA 30655

CALL OR TEXT

EMAIL US

Abundance, LLC

678.884.8841 (Call or Text)

248 North Broad Street

Monroe, GA 30655

connect@findabundance.com

Securities offered through Kestra Investment Services, LLC, (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. Abundance is not affiliated with Kestra IS or Kestra AS.

Investor Disclosures: https://www.kestrafinancial.com/disclosures

This site is published for residents of the United States only. Registered Representatives of Kestra Investment Services, LLC and Investment Advisor Representative of Kestra Advisory Services, LLC, may only conduct business with residents of the states and jurisdictions in which they are properly registered. Therefore, a response to a request for information may be delayed. Not all of the products and services references on this site are available in every state and through every representative or advisor listed. Neither Kestra IS or Kestra AS provides legal or tax advice. For additional information, please contact our Compliance department at 844.553.7872.

Website by Faithworks Marketing