THE CASE FOR A SOFT LANDING: ARGUMENTS FALTERING AS GLOBAL ECONOMY FACES CHALLENGES

The soft landing narrative is on its last leg. In economics, a soft landing refers to a smooth transition from a period of rapid growth to a more sustainable level. Many experts had hoped that the global economy would experience a soft landing, supported by three main arguments. However, as we delve deeper into the current economic landscape, it becomes apparent that these arguments are not playing out as expected. This week's article aims to explore the reasons behind the diminishing likelihood of a soft landing, with a specific focus on the faltering arguments surrounding China's reopening, Europe's struggle to rebound, and the deteriorating US job market.

China's Reopening: A Disappointing Boost to the Economy

One of the key arguments put forth for a soft landing was the expectation that China's reopening would stimulate global economic growth. However, recent developments indicate that China's reopening is not proceeding as anticipated. The economic data reported for China in the month of May shows declining trade and an economic slowdown. The country's trade volumes have decreased, resulting in a contraction in exports and reduced consumer spending. According to the report, China shows a 7.5% decline in exports from last May and a 4.5% decline in imports [1].

April’s “disappointing activity data” suggests “China’s domestic demand recovery has lost steam following the reopening-induced bounce,” Said Lloyd Chan of Oxford Economics [1]. These factors have hindered the expected economic boost, highlighting the challenges faced by China and its potential impact on the global economy.

Europe's Struggle: Failing to Rebound After Energy Crisis

Another argument for a soft landing revolved around the belief that Europe would rebound following the energy crisis that ended around March of this year [2]. However, there continues to be a slowing of global economies, with a particular emphasis on Germany. German factory orders, a significant indicator for Europe's largest economy, have dipped, indicating a disappointing start to the second quarter. Furthermore, Germany experienced a contraction in its gross domestic product (GDP) during the first quarter of the year, marking a potential recession [3]. Germany is traditionally one of the strongest economies in Europe. These developments raise concerns about Europe's economic recovery and its ability to rebound as initially anticipated.

In addition to what we're seeing in Germany, there is supporting evidence that economic slowdowns are happening across the world. A World Bank report estimates that the international economy will expand just 2.1% in 2023 after growing 3.1% in 2022 [4]. Indermit Gill, the World Bank’s chief economist, called the latest findings “another gloomy report." The bank, he said, expects “last year’s sharp and synchronized slowdown to continue to this year into a sharp slowdown.” [4]

US Job Market: Struggling Amid Rising Jobless Claims

The final argument being made for the soft landing was a strong jobs market. For the most part the US job market remains strong but is beginning to face some challenges. As of this past week, jobless claims in the US are at their highest levels since 2021 [5]. This rise in jobless claims signifies a weakening job market, with economic uncertainty and reduced business activity as contributing factors. The struggling job market in the US has significant implications for the overall health of the economy and casts doubt on the likelihood of a soft landing. The job market serves as a crucial indicator of economic stability and consumer confidence, making this downturn a cause for concern.

Conclusion

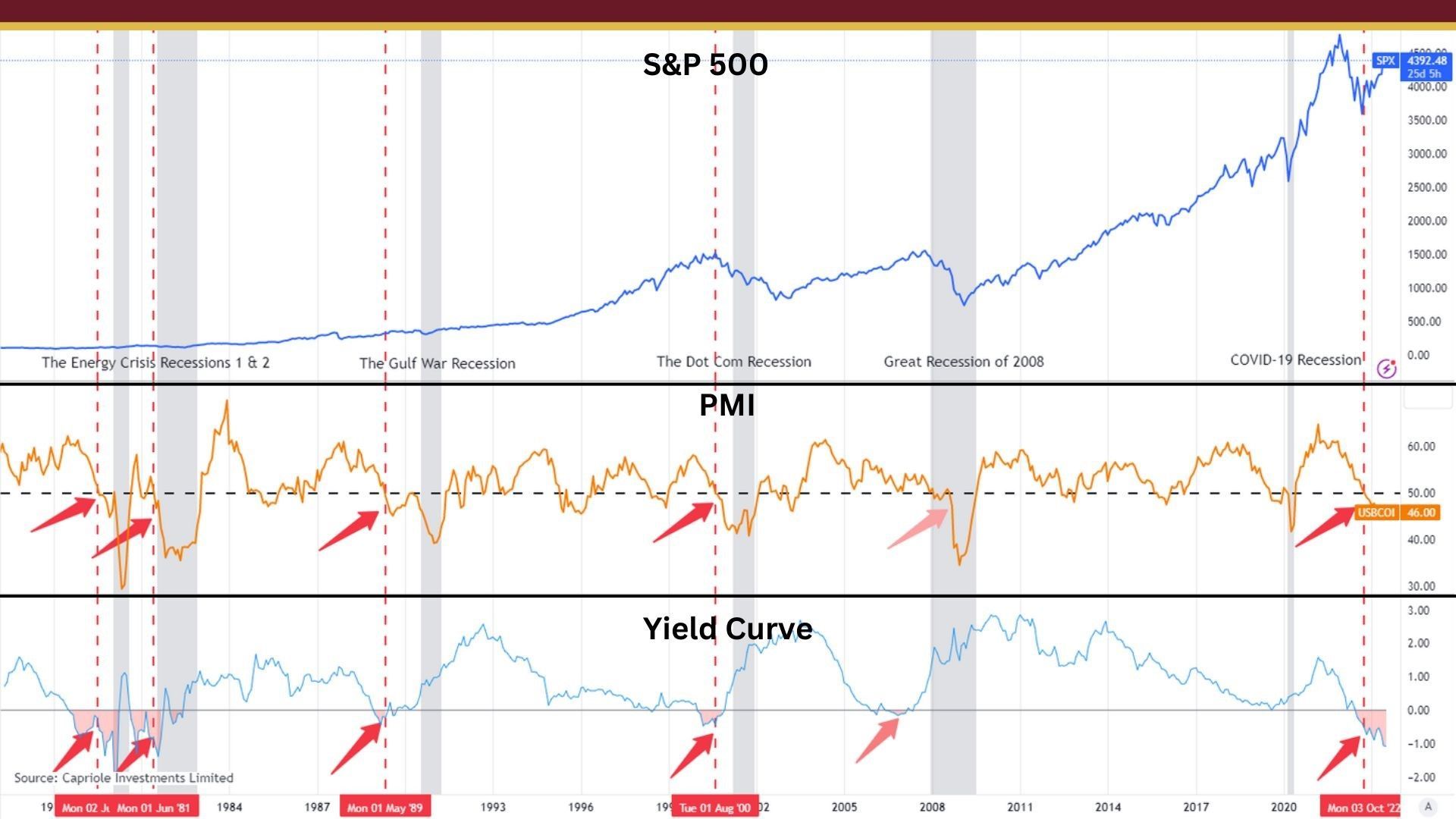

As we analyze the current state of the global economy, it becomes evident that the arguments supporting a soft landing are losing traction. China's reopening has not generated the expected economic boost, with declining trade and reduced consumer spending dampening its impact. Europe, specifically Germany, is facing economic challenges, as seen in the slowing factory orders and the potential onset of a recession. The US job market is also struggling, as evidenced by the increase in jobless claims. These factors collectively question the feasibility of a soft landing in the global economy.

In conclusion, while hopes were high for a soft landing, the reality is painting a different picture. The arguments surrounding China's reopening, Europe's rebound, and the strength of the US job market are not playing out as anticipated. By acknowledging these challenges and adapting our strategies, we can better navigate the evolving economic landscape and work towards achieving a sustainable and resilient global economy. Our Directional Portfolios aim to build a portfolio that will adjust with the business cycle. If you'd like to learn more, you can call or text at 678.884.8841 or email us at connect@findabundance.com.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Sources:

- [1]: https://apnews.com/article/china-trade-economy-recovery-f56dc3c1b60446d55560be4aff9eb1d8

- [2]: https://www.politico.eu/article/europe-is-out-of-the-immediate-energy-crisis/

- [3]: https://apnews.com/article/germany-industrial-orders-economy-7210f9ec27d632d99b033dca2bb8e15e

- [4]: https://abcnews.go.com/US/wireStory/world-bank-offers-dim-outlook-global-economy-face-99867179

- [5]: https://www.nasdaq.com/articles/us-weekly-jobless-claims-jump-to-1-1-2-year-high

Schedule a Discovery Call

Schedule a Consultation

We will get back to you as soon as possible.

Please try again later.

VISIT US

Stop by and see us at the historic, Nowell-Wheeler House.

(Parking is available behind the building and along Williams Street)

248 North Broad Street

Monroe, GA 30655

CALL OR TEXT

EMAIL US

Abundance, LLC

678.884.8841 (Call or Text)

248 North Broad Street

Monroe, GA 30655

connect@findabundance.com

Securities offered through Kestra Investment Services, LLC, (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. Abundance is not affiliated with Kestra IS or Kestra AS.

Investor Disclosures: https://www.kestrafinancial.com/disclosures

This site is published for residents of the United States only. Registered Representatives of Kestra Investment Services, LLC and Investment Advisor Representative of Kestra Advisory Services, LLC, may only conduct business with residents of the states and jurisdictions in which they are properly registered. Therefore, a response to a request for information may be delayed. Not all of the products and services references on this site are available in every state and through every representative or advisor listed. Neither Kestra IS or Kestra AS provides legal or tax advice. For additional information, please contact our Compliance department at 844.553.7872.

Website by Faithworks Marketing