DEBT CEILING COUNTDOWN: HOW IT COULD SHAKE UP THE JOB MARKET AND YOUR FINANCES

In a time of significant challenges, the United States is currently facing two critical issues: the debt ceiling debate and the state of the job market. The consequences of inaction in these areas can have far-reaching impacts on the economy, financial markets, and individual livelihoods. In this article, we will delve into the potential consequences of inaction, proposed amendments, the resilience of the job market, and the implications for financial markets. It is vital to address these challenges promptly and thoughtfully to ensure economic stability and maintain investor confidence.

Understanding the Debt Ceiling and Consequences of Inaction

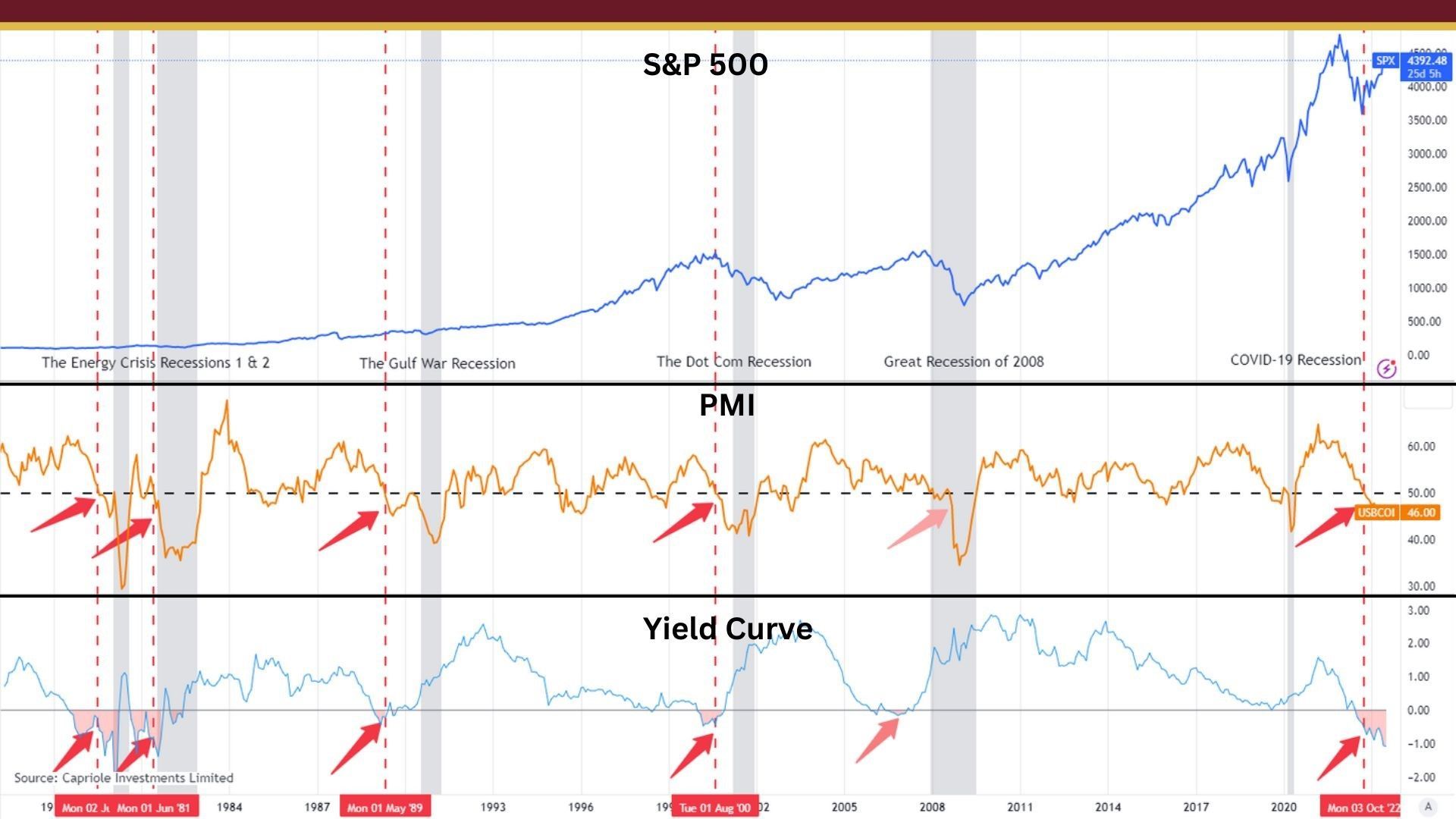

Having discussed the debt ceiling in previous weeks we will not dive deep into the ramifications of potential default as we know failure to pass the debt ceiling bill by the June 5 deadline could result in an inability to meet financial obligations, including debt payments, Social Security benefits, and military salaries. This scenario would trigger a severe financial crisis, impacting not only the government but also businesses and individuals. The uncertainty surrounding a potential default would most likely lead to market volatility and a loss of investor confidence.

Lawmakers have proposed amendments to the debt ceiling bill, aiming to introduce spending cuts and increase defense spending [1]. However, any changes to the bill would require it to be sent back to the House for review, potentially causing delays and creating additional uncertainty. It is essential for lawmakers to find common ground, foster bipartisan cooperation, and consider alternative solutions that can ensure the timely passage of the debt ceiling bill. A swift resolution to this debate is critical to instill market stability and investor trust.

Job Market Resilience, Challenges, and Industry Impact

This past week the Federal reserve published one of their Beige Book reports. It provides a qualitative assessment of the current economic conditions in each of the 12 Federal Reserve districts across the United States. The report gathers information from various sources, including businesses, economists, market experts, and other contacts within each district. In addition to their report, we've seen a recent uptick in unemployment claims and layoffs in May.

In spite of a recent increase in Americans filing for unemployment benefits, the job market has shown resilience. Employers, faced with challenges in finding qualified employees, have generally held onto their workforce. However, certain industries, such as technology and interest rate-sensitive sectors, have experienced job cuts due to economic uncertainties. These challenges highlight the need for measures and initiatives to address industry-specific issues and foster a sustainable job market recovery.

Economists predict a slowdown in job growth, but there are hopes that the unemployment rate is will rise only slightly [2]. The Federal Reserve's Beige Book report describes the job market as strong, but it also highlights that some businesses are pausing hiring or reducing their workforce due to weaker demand or economic uncertainties. This cautious approach may impact consumer spending and overall economic growth. Furthermore, a default or prolonged debate on the debt ceiling could have long-term implications for the economy, including higher borrowing costs, reduced business investment, and diminished consumer confidence.

Navigating the Challenges and Ensuring Economic Stability

At the time of this writing, the debt ceiling bill has been approved in the House and passed to the Senate for the final stamp of approval[1]. The debt ceiling debate and the state of the job market have significant implications for financial markets. Uncertainty surrounding the debt ceiling can lead to increased market volatility, as investors become cautious about the government's ability to meet its financial obligations. Investors will closely monitor the progress of the debt ceiling bill, and any signs of prolonged debate or a potential default can impact market sentiment. Therefore, a timely resolution to the debt ceiling debate is crucial for restoring and maintaining investor confidence.

Conclusion:

The outcome of the debt ceiling debate and the state of the job market have significant implications for financial markets. Investor confidence is closely tied to the government's ability to manage its financial obligations and maintain economic stability. Any signs of prolonged debate or a potential default can lead to increased market volatility and a loss of investor trust. Therefore, a swift resolution to the debt ceiling issue is crucial for restoring and maintaining market stability.

Furthermore, the long-term implications of these challenges should not be overlooked. A default or prolonged debate could result in higher borrowing costs, reduced business investment, and diminished consumer confidence. This can hamper economic growth and have far-reaching consequences across various sectors. Policymakers must consider the potential ripple effects and work towards mitigating risks to ensure a sustainable and inclusive recovery.

In conclusion, the debt ceiling debate and the state of the job market pose critical challenges for the United States. Swift action is necessary to pass the debt ceiling bill, avoid a potential default, and maintain investor confidence. The resilience of the job market is commendable, but efforts should be made to address industry-specific issues and foster a sustainable recovery. By prioritizing economic stability, finding common ground, and investing in initiatives that support growth and innovation, we can navigate these challenges and build a stronger and more inclusive economy for the future.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Sources:

Schedule a Discovery Call

Schedule a Consultation

We will get back to you as soon as possible.

Please try again later.

VISIT US

Stop by and see us at the historic, Nowell-Wheeler House.

(Parking is available behind the building and along Williams Street)

248 North Broad Street

Monroe, GA 30655

CALL OR TEXT

EMAIL US

Abundance, LLC

678.884.8841 (Call or Text)

248 North Broad Street

Monroe, GA 30655

connect@findabundance.com

Securities offered through Kestra Investment Services, LLC, (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. Abundance is not affiliated with Kestra IS or Kestra AS.

Investor Disclosures: https://www.kestrafinancial.com/disclosures

This site is published for residents of the United States only. Registered Representatives of Kestra Investment Services, LLC and Investment Advisor Representative of Kestra Advisory Services, LLC, may only conduct business with residents of the states and jurisdictions in which they are properly registered. Therefore, a response to a request for information may be delayed. Not all of the products and services references on this site are available in every state and through every representative or advisor listed. Neither Kestra IS or Kestra AS provides legal or tax advice. For additional information, please contact our Compliance department at 844.553.7872.

Website by Faithworks Marketing