NAVIGATING THE PARADOX: A NEW TECHNICAL BULL MARKET IN THE FACE OF A SLOWING ECONOMY

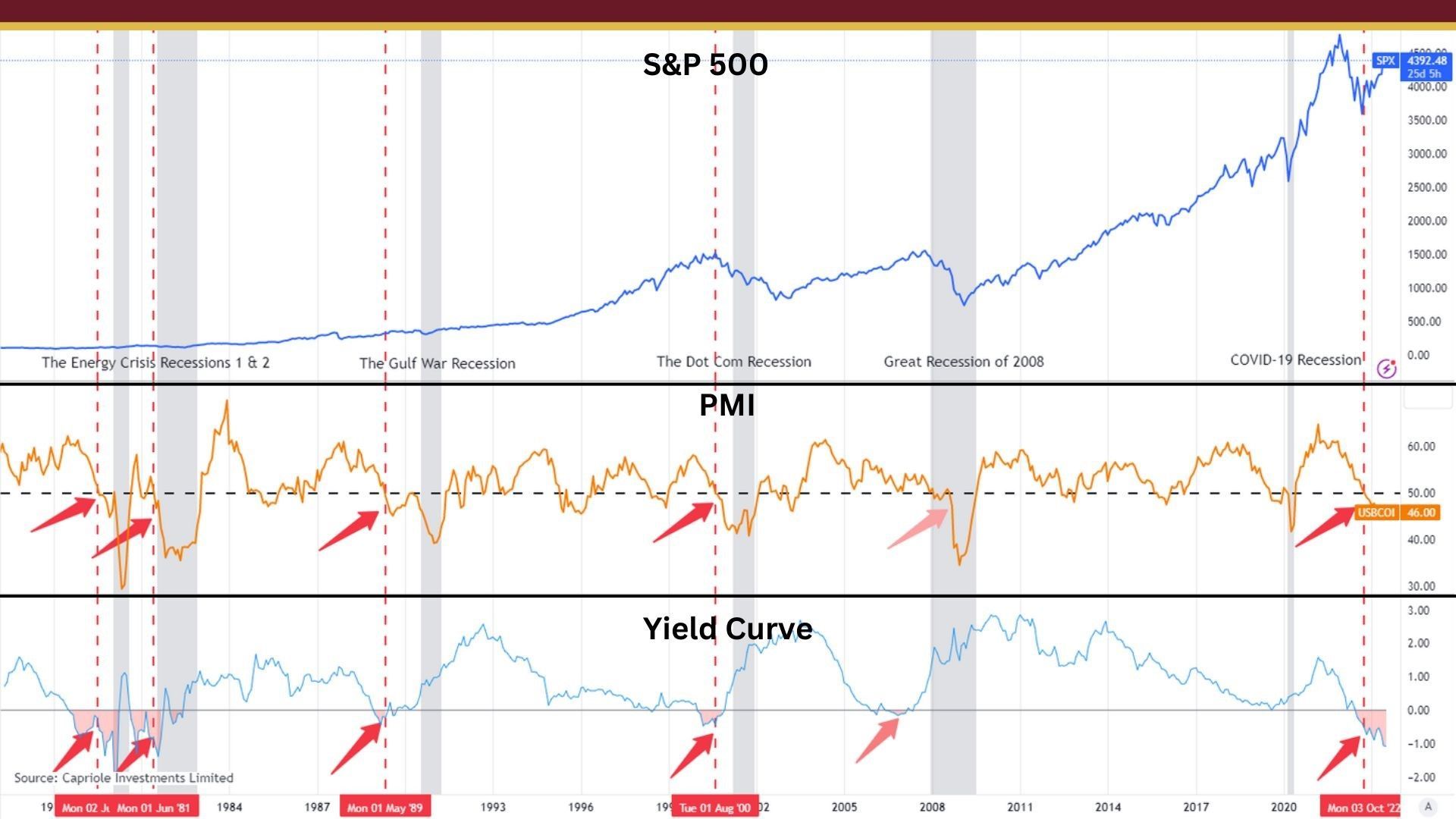

In the past week the stock market has technically entered a new bull market. Bull and bear markets are technically defined by a 20% move from the recent low. We recently saw the S&P cross this threshold as it surged 20% since the lows in October 2022[1].

In the world of investing, the emergence of a new bull market is often met with excitement and optimism. However, the current situation is marked by an intriguing contradiction—the markets have technically entered a new bull market while the broader economy shows signs of a slowdown. In this week’s update, we will explore this paradox, examining the indicators of a new bull market while considering the challenges posed by a sluggish economy.

Market Resurgence: A Technical New Bull Market

Despite the economic headwinds, numerous experts argue that the markets have entered a new bull market. There is a lot of enthusiasm around the market gains and the newly declared bull market. Yet, it's important to realize that the market is not always a good judge of the economy. In fact, it's a better measure on how people feel about where the market is heading. A positive move in the market is suggesting a positive outlook.

One way to determine this sentiment is to follow CNN's Fear and Greed Index. The Fear & Greed Index is a way to gauge stock market movements and whether stocks are fairly priced. The theory is based on the logic that excessive fear tends to drive down share prices, and too much greed tends to have the opposite effect [2]. The index has a rating of 0-100, and we're currently sitting at a level of 82 which is categorized as "extreme greed" [3]. What does this mean for the future of the markets? I don't know … time will tell, but there are a definitely a handful of signs that point to a slowing economy that could quickly shift the renewed optimism back to pessimism.

Economic Concerns: Signs of a Slowing Economy

Amidst the market's resurgence, it's essential to acknowledge the concerning state of the economy. US manufacturing is experiencing minimal growth, while inventories have reached levels that hinder future expansion [4]. Additionally, the labor market, although the numbers have stayed strong, exhibits signs of strain. In my opinion, the data is suggesting that demand is slowing and it's forcing businesses into making difficult financial decisions. Essentially, cutting labor force is the last and final option to reduce costs. Things have stayed very stable but we're starting to see initial claims of unemployment continue to tick up each week [5]. We're also seeing companies resort to labor hoarding [6] and reducing hours worked [7] to retain employees.

Labor hoarding is a sign that businesses are worried about the future and are trying to protect themselves from a potential recession. There are a number of reasons why businesses are hoarding labor. One reason is that the labor market is very tight, with unemployment at a record low. This makes it difficult for businesses to find qualified workers, and businesses are reluctant to lay off workers who they may need in the future. [6]

Another reason for labor hoarding is that businesses are worried about a potential recession. If a recession does occur, businesses may need to reduce production or even close down. By hoarding labor, businesses can ensure that they have the staff they need to weather a recession.[6]

The Lingering Banking Crisis

The other major red flag for me are the signs of the lingering banking crisis. This is not something that has stayed in the headlines. In fact, I believe part of the optimism in the current markets is due to the fact that many believed the banking crisis that occurred earlier this year would have a major impact on the labor markets. Therefore, it makes sense why optimism would return when the crisis seems to have passed with little impact to the labor markets.

Despite outward signs of recovery, it does not appear that banks have returned to their normal lending activities. This is highlighted by the idea that a well known real estate developer in Texas is having a difficult time finding a bank willing to lend to them for their projects [8].

Despite a demand for new apartments, Howard Hughes Corp., a real estate developer backed by hedge fund manager Bill Ackman, is struggling to find financing for new apartment projects. The company has reached out to dozens of lenders, but none have shown interest in providing funding. This is due to a number of factors, including rising interest rates and concerns about the overall health of the real estate market. As a result, Howard Hughes is having to delay or cancel some of its planned projects. [8]

This is a sign of the challenges facing the real estate industry, as lenders become more cautious about lending money for new projects. This is also a sign that banks are not back to business as usual because lending is the life blood of their business model. This can be signaling that banks are not confident about the future and doing everything they can to avoid risk and potential default.

Conclusion:

To comprehend this paradox, it is crucial to consider the interplay between market sentiment and economic indicators. While economic indicators reflect the current state of affairs, market sentiment often guides investor behavior. The surge in the market, despite a sluggish economy, underscores the influence of sentiment over economic realities. Solely relying on economic indicators may not capture the complexities of the market.

This presents investors with a unique challenge—managing a new bull market amidst a slowing economy. While the markets display renewed vigor, economic indicators warn of potential hurdles. To navigate this paradox, a balanced approach is crucial and we must remain attentive to both market sentiment and economic realities. Our Directional Portfolios aim to build a portfolio that will adjust with the business cycle. If you'd like to learn more, you can call or text at 678.884.8841 or email us at connect@findabundance.com.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Sources:

- https://www.nasdaq.com/articles/a-new-bull-market-has-begun

- https://www.cnn.com/markets/fear-and-greed?utm_source=business_ribbon#fng-faq

- https://www.cnn.com/markets/fear-and-greed?utm_source=business_ribbon

- https://www.reuters.com/markets/us/us-manufacturing-output-barely-grows-may-2023-06-15/

- https://apnews.com/article/unemployment-benefits-jobless-claims-layoffs-labor-140978ffe6a95f5a4efa84406d5e9421

- https://www.cnn.com/2023/06/08/economy/labor-hoarding-economy/index.html

- https://fred.stlouisfed.org/series/AWHAETP

- https://www.bloomberg.com/news/articles/2023-06-08/real-estate-builder-backed-by-ackman-says-lenders-rejecting-new-apartment-deals#xj4y7vzkg

Schedule a Discovery Call

Schedule a Consultation

We will get back to you as soon as possible.

Please try again later.

VISIT US

Stop by and see us at the historic, Nowell-Wheeler House.

(Parking is available behind the building and along Williams Street)

248 North Broad Street

Monroe, GA 30655

CALL OR TEXT

EMAIL US

Abundance, LLC

678.884.8841 (Call or Text)

248 North Broad Street

Monroe, GA 30655

connect@findabundance.com

Securities offered through Kestra Investment Services, LLC, (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. Abundance is not affiliated with Kestra IS or Kestra AS.

Investor Disclosures: https://www.kestrafinancial.com/disclosures

This site is published for residents of the United States only. Registered Representatives of Kestra Investment Services, LLC and Investment Advisor Representative of Kestra Advisory Services, LLC, may only conduct business with residents of the states and jurisdictions in which they are properly registered. Therefore, a response to a request for information may be delayed. Not all of the products and services references on this site are available in every state and through every representative or advisor listed. Neither Kestra IS or Kestra AS provides legal or tax advice. For additional information, please contact our Compliance department at 844.553.7872.

Website by Faithworks Marketing