CHINA'S RATE CUTS AND THEIR GLOBAL IMPLICATIONS

Introduction

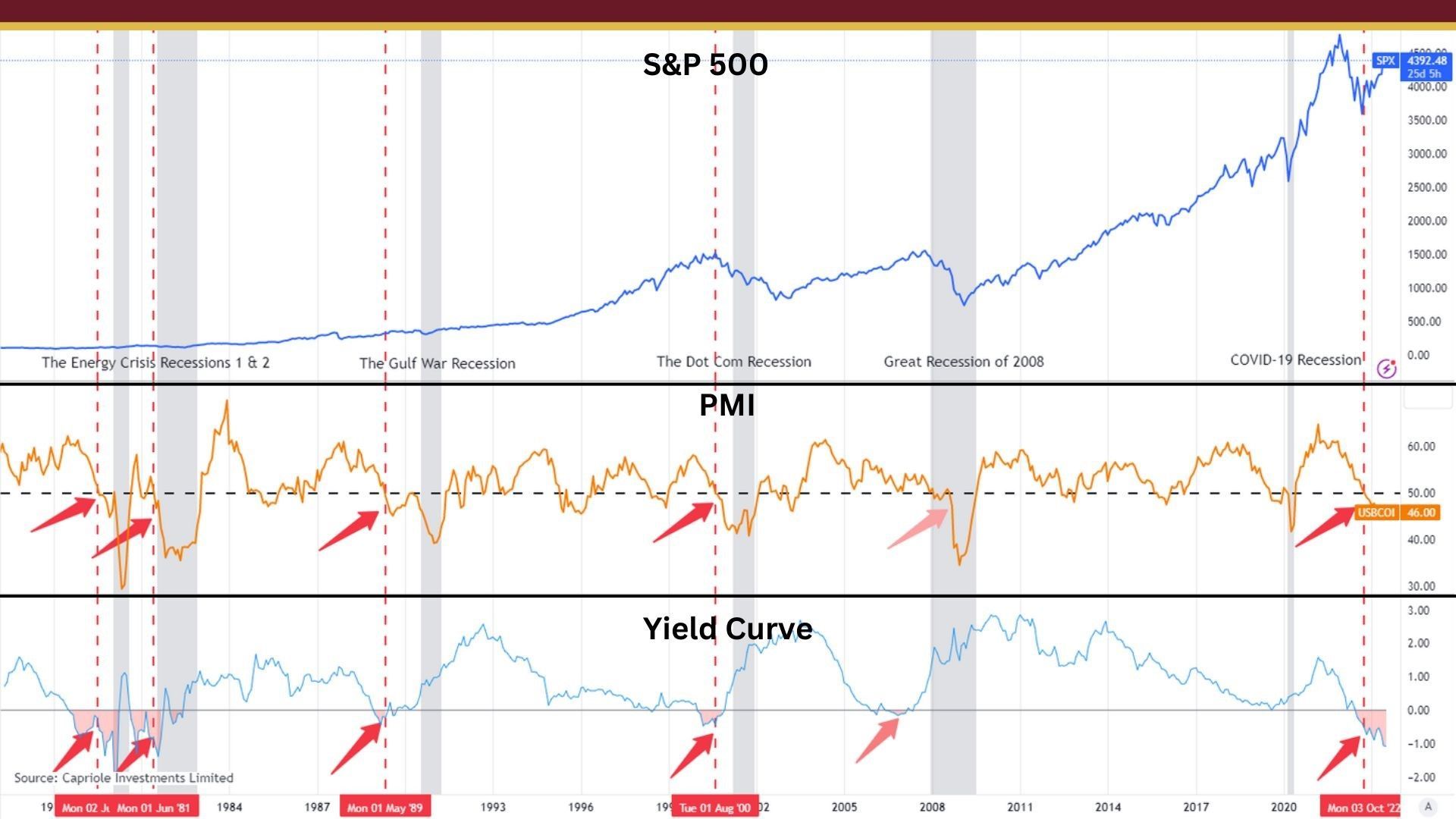

The global economy is showing worrisome signs of a synchronized deflationary recession, with China's recent interest rate cut serving as a significant indicator. However, central banks worldwide remain focused on inflation and tight labor markets, overlooking the potential risks associated with increasing rates during an economic slowdown. In this week's article, we will explore the implications of these trends and highlight the importance of a comprehensive approach to address the challenges ahead.

Overview of Recent Rate Cuts in China

China's decision to cut lending benchmarks comes as authorities seek to revitalize a slowing economic recovery. The one-year loan prime rate (LPR) was lowered by 0.1 percent to 3.55%, while the five-year LPR was reduced by the same margin to 4.20% [1]. Although the cuts were anticipated, the smaller-than-expected reduction in the five-year rate disappointed some investors, leading to a drop in the Hang Seng Mainland Properties Index and a dip in broader Asian stock markets.

These rate cuts aim to lower the cost of new loans and ease interest payments on existing loans [1. While they are expected to offer modest support to economic activity, weak credit demand may prevent a sharp acceleration in credit growth. As one of the world's largest economies, China's actions often foreshadow wider economic shifts. In my opinion, this rate cut serves as a cautionary signal that should not be ignored in assessing the current economic landscape.

Divergent Monetary Policy Worldwide

The global landscape of monetary policy reveals a divergence in approaches among major central banks. Central banks typically prioritize inflation as a key economic indicator, while the labor market's tightness also plays a crucial role [2]. However, an exclusive focus on inflation may lead to an incomplete understanding of the overall economic health. Neglecting signs of an economic slowdown, such as a tight labor market, can hinder effective policymaking and response strategies.

The European Central Bank (ECB) recently hiked rates and signaled a worsening inflation outlook. In contrast, the Federal Reserve opted to pause rate hikes during their most recent meeting but have suggested future rate hikes later this year. These central banks are creating a hyper focus on inflation because they believe that the labor markets are in good shape as unemployment numbers have stayed a good level. Yet, according to a Skynova survey in February, 91% of businesses are actively labor hoarding [3].

Labor hoarding is where businesses retain a larger workforce than necessary[3]. The rationale behind this practice lies in the long-term cost-benefit analysis and the desire to maintain a positive outlook for the firm. I believe this is happening because many business owners expect a shallow recession. Therefore, it's more cost effective to hold on to labor and make it through a shallow recession than it is to lay off and rehire a large amount of your workforce.

However, if the China rate cuts are signaling a greater economic slowdown, businesses will be forced to lay off the excess labor they have been retaining, magnifying the impact of the recession.

Global Implications of China's Rate Cuts

China's rate cuts hold significant implications for the global economy. As the second-largest economy in the world, China's actions have a ripple effect on global trade, investment, and financial markets. The rate cuts are expected to reduce loan costs and provide some support to economic activity, which could have positive effects on global trade dynamics.

We'll see if China's rate cuts could influence the decisions of other major central banks. The Federal Reserve, for example, may consider the global economic environment and China's actions when determining its future rate hike plans. The ECB, which recently hiked rates and expressed the likelihood of further increases, may also be influenced by China's monetary policy decisions. These interconnected relationships emphasize the importance of monitoring China's actions and their potential implications for global monetary policy coordination.

Conclusion

As the world's second-largest economy, China's monetary policy decisions carry significant weight that should not be overlooked. While the rate cuts are expected to provide support to economic activity in China, their impact on the global stage is also of great importance. In general, rate cuts signal that an economy needs to be stimulated due to a lack of demand. I believe we're already seeing signs of a globally synchronized recession as Germany technically entered a recession in May [4] and New Zealand technically fell into a recession in the past couple of weeks [5]. Our Directional Portfolios aim to build a portfolio that will adjust with the business cycle. If you'd like to learn more, you can call or text at 678.884.8841 or email us at connect@findabundance.com.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Sources:

- https://www.reuters.com/world/china/china-cuts-lending-benchmarks-first-time-10-months-support-economy-2023-06-20/

- https://www.cnbc.com/2023/06/19/fed-ecb-boj-pboc-central-banks-monetary-policy-decision-are-diverging.html

- https://www.realclearmarkets.com/articles/2023/06/16/policymakers_will_need_a_miracle_not_a_pause_941110.html

- https://www.conference-board.org/blog/global-economy/Germany-GDP-forecast-recession

- https://www.bbc.com/news/business-65911732

Schedule a Discovery Call

Schedule a Consultation

We will get back to you as soon as possible.

Please try again later.

VISIT US

Stop by and see us at the historic, Nowell-Wheeler House.

(Parking is available behind the building and along Williams Street)

248 North Broad Street

Monroe, GA 30655

CALL OR TEXT

EMAIL US

Abundance, LLC

678.884.8841 (Call or Text)

248 North Broad Street

Monroe, GA 30655

connect@findabundance.com

Securities offered through Kestra Investment Services, LLC, (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. Abundance is not affiliated with Kestra IS or Kestra AS.

Investor Disclosures: https://www.kestrafinancial.com/disclosures

This site is published for residents of the United States only. Registered Representatives of Kestra Investment Services, LLC and Investment Advisor Representative of Kestra Advisory Services, LLC, may only conduct business with residents of the states and jurisdictions in which they are properly registered. Therefore, a response to a request for information may be delayed. Not all of the products and services references on this site are available in every state and through every representative or advisor listed. Neither Kestra IS or Kestra AS provides legal or tax advice. For additional information, please contact our Compliance department at 844.553.7872.

Website by Faithworks Marketing