WHY THE RISE IN SHELTER CPI IS A WARNING SIGN FOR THE ECONOMY

The latest Consumer Price Index (CPI) release is out, and it's raising some red flags. Consumer prices rose at a slower pace in March, with inflation showing signs of easing. The Consumer Price Index (CPI) revealed that headline inflation rose by just 0.1% over last month and 5.0% over the prior year. This is a slowdown from the increase that we saw in February. While it's still above the Federal Reserve's 2% target, it's the slowest increase since May 2021.[1]

While most welcome a slowdown in inflation, it's the details buried within the report that are causing concern. Specifically, the shelter portion of the CORE CPI, which measures the cost of housing. The shelter index increased 8.2% over the last year, accounting for over 60% of the total increase in core inflation. [1]

In this week's article, we'll take a closer look at the latest CPI release, focusing specifically on the rise of the shelter portion of CORE CPI and what it means for the economy. We'll explore the potential implications of declining demand and discuss what steps businesses and consumers can take to weather any economic slowdowns that may be on the horizon.

Core CPI

On a "core" basis, which strips out the more volatile costs of food and gas, prices in March climbed 0.4% over the prior month and 5.6% over last year. This was in-line with economist expectations. However, core inflation remained especially sticky last month amid surging rents. The index for rent and the index for owners’ equivalent rent both rose 0.5% in March following larger increases in the previous month. [1]

The Fed has been raising interest rates to try to bring down inflation, but the central bank risks sending the economy into a recession by hiking rates too high too fast. According to data from the CME Group, markets are anticipating that the Federal Reserve raises rates by another 0.25% in May, and forecasts from the central bank released last month suggested one additional 0.25% rate increase was likely this year.

Pay Attention to Shelter

When the shelter portion of the core Consumer Price Index (CPI) is increasing significantly more than the rest, it generally indicates that there is upward pressure on the cost of housing and rent, which can have a number of implications for the overall economy.

On the positive side, an increase in the shelter component of core CPI may reflect a healthy housing market, with increased demand for housing driving up prices. This can be a positive sign for the economy, as it can lead to increased construction activity and job creation in the housing industry.

However, if the increase in the shelter component is driven by a lack of affordable housing or a shortage of rental units, it can have negative implications for the economy. For example, if housing costs become too expensive, it can lead to decreased consumer purchasing power and reduced spending on other goods and services. Additionally, if rental prices rise too quickly, it can lead to increased homelessness or overcrowding, which can have negative social and economic impacts.

In our opinion, increase of the shelter CPI is a result of housing being less affordable. Recent research reveals that 39% of Americans have skipped meals to make housing payments. [2] The labor market is also flashing signs of a potential recession as job openings have started to decline [3] and there was a recent uptick in claims for unemployment [4].

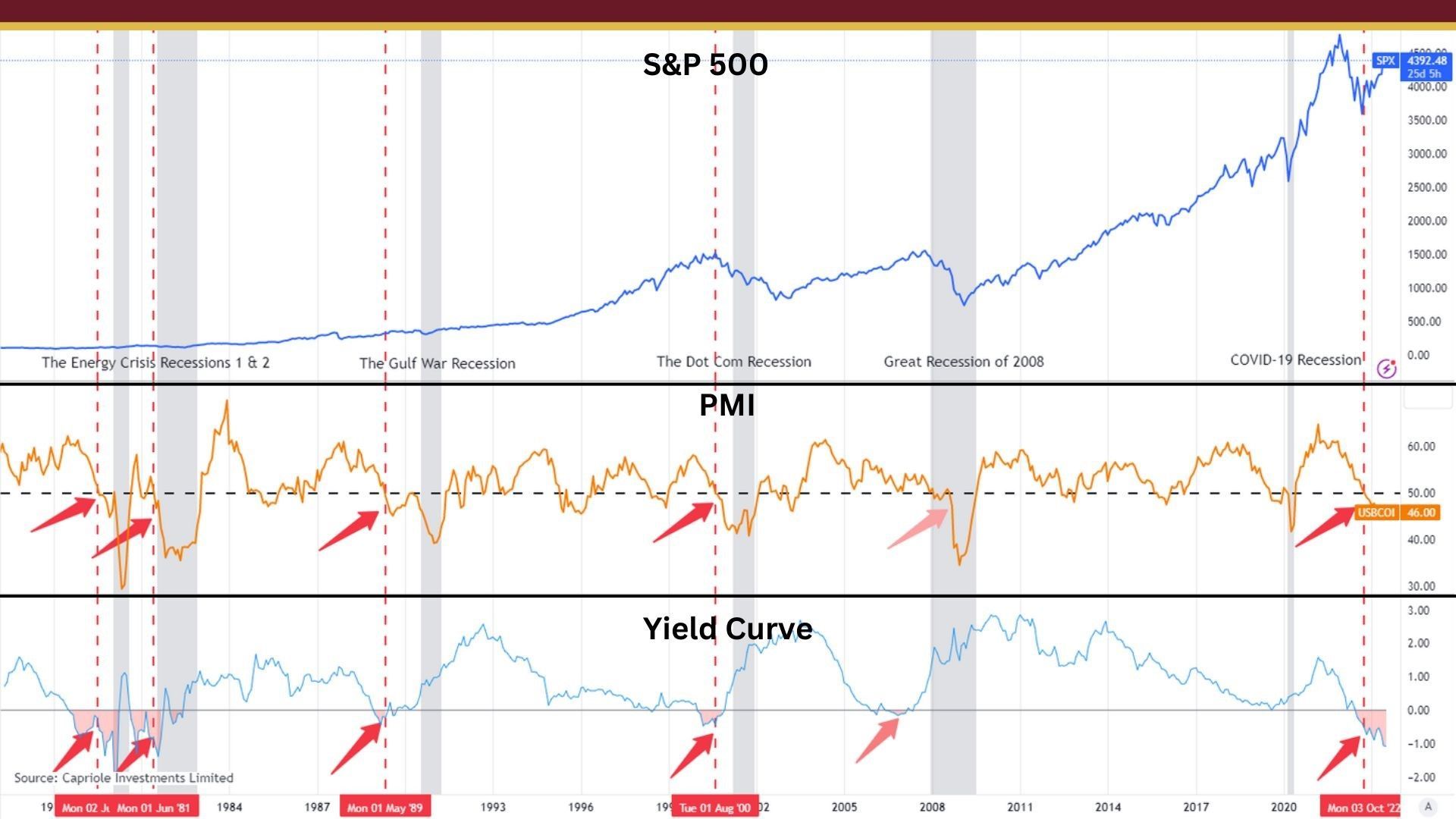

Historical Precedent

One such example is the period between 2006 and 2009, during the U.S. housing market crash and subsequent recession. During this time, the shelter CPI increased significantly due to the high number of foreclosures and the subsequent decrease in the supply of available housing. At the same time, other components of core CPI, such as the prices of goods and services, were decreasing due to the overall economic downturn.

Another example is the period between 1979 and 1983, during which the United States experienced high inflation due to a combination of factors, including rising energy prices and increased government spending. During this time, the shelter CPI increased while other components of core CPI were decreasing, partly due to a decline in the demand for goods and services.

Here are a few points to consider about these two periods of time:

- Both periods saw a rise in oil prices which is similar to what we've seen over the past couple of weeks

- 2006 started a wave of defaults on mortgages. The decline in the housing market and the resulting losses in the financial sector led to a credit crunch, as banks and other lenders became hesitant to lend money to each other or to consumers and businesses. This further slowed down the economy and contributed to the decline in the stock market.

- Other factors that contributed to the decline in the stock market in 2008, include high levels of consumer debt, rising oil prices, and the failure of several large financial institutions, such as Lehman Brothers, which further eroded investor confidence.

- The U.S. Federal Reserve continued to raise interest rates throughout 1980, which further slowed economic growth and contributed to the decline in the stock market.

Conclusion

While a slowdown in inflation is generally welcomed, the increase in the cost of housing and rent can have negative implications for the economy, especially if it's driven by a lack of affordable housing. The historical precedent suggests that a rise in shelter CPI, coupled with declining demand, could lead to a downturn. It remains to be seen how the Federal Reserve will respond to these indicators, and if the current rate hikes could potentially send the economy into a recession. Abundance is here to help you prosper regardless of the economy. Our Directional Portfolios aim to build a portfolio that will adjust with the business cycle. If you'd like to learn more, you can call or text at 678.884.8841 or email us at connect@findabundance.com.

Sources:

- https://finance.yahoo.com/news/inflation-cpi-march-april-12-2023-172921113.html

- https://www.marketwatch.com/story/39-of-americans-say-theyve-skipped-meals-to-make-housing-payments-and-why-is-the-tax-deadline-april-18-this-year-instead-of-april-15-c6146b9f

- https://fred.stlouisfed.org/series/JTSJOL

- https://www.reuters.com/markets/us/us-weekly-jobless-claims-increase-labor-market-slows-2023-04-13/

Schedule a Discovery Call

Schedule a Consultation

We will get back to you as soon as possible.

Please try again later.

VISIT US

Stop by and see us at the historic, Nowell-Wheeler House.

(Parking is available behind the building and along Williams Street)

248 North Broad Street

Monroe, GA 30655

CALL OR TEXT

EMAIL US

Abundance, LLC

678.884.8841 (Call or Text)

248 North Broad Street

Monroe, GA 30655

connect@findabundance.com

Securities offered through Kestra Investment Services, LLC, (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. Abundance is not affiliated with Kestra IS or Kestra AS.

Investor Disclosures: https://www.kestrafinancial.com/disclosures

This site is published for residents of the United States only. Registered Representatives of Kestra Investment Services, LLC and Investment Advisor Representative of Kestra Advisory Services, LLC, may only conduct business with residents of the states and jurisdictions in which they are properly registered. Therefore, a response to a request for information may be delayed. Not all of the products and services references on this site are available in every state and through every representative or advisor listed. Neither Kestra IS or Kestra AS provides legal or tax advice. For additional information, please contact our Compliance department at 844.553.7872.

Website by Faithworks Marketing