RECESSION OR SOFT LANDING?

One of the biggest pieces of economic news from the past week was the January jobs report that reported a shocking increase of 517,000 jobs to the nonfarm payrolls, and the unemployment rate fell to 3.4%. Both numbers beat the estimates of 187,000 jobs and 3.6% unemployment rate.

Receiving such a positive report added fuel to the fire of the "soft landing" versus an impending recession debate. In order to win in these markets, it becomes crucial to be able to accurately discern what is noise and what is news (aka … noteworthy information).

If you're not a regular student of economic reports, the nonfarm payroll measures the number of workers in the U.S. except those in farming, private households, proprietors, non-profit employees, and active military. The report contains insights into the labor force that directly impact the economy, the stock market, the value of the U.S. dollar, the value of Treasuries, and the price of gold.

The goal today is to cut through the noise of the soft landing versus recession debate by reviewing how the essential players are currently positioned.

Soft Landing Versus Recession Debate

In economics, a soft landing is a slowdown in economic growth that avoids a recession. A recession is a significant and prolonged downturn in economic activity. You will typically hear experts reference the rule of thumb that a recession occurs when there are two consecutive quarters of negative GDP.

Essentially, no one is debating whether or not the economy is slowing down. They're debating how painful the slowdown will be.

Soft landing = a relatively short and painless slowdown

Recession = a prolonged pain

The Main Economic Players

The Federal Reserve - Historically, the Fed's role in the economy is 1.) maintain stable prices and 2.) achieve full employment. These goals are met when annual inflation is around 2% and unemployment is around 4% to 5%.

The US Government - The government has an impact on the economy through government spending and taxation. Taxation is the government's revenue source to cover national spending, and national debt occurs when national spending is greater than the tax revenue.

Businesses - Businesses play a vital role in the economy because they provide goods and services to satisfy the needs and wants of the people, they create jobs and income that allow people to have a higher quality of life, and they create growth through innovation. Their innovations and efficiencies can increase the quality of products and make them more affordable.

Consumers - Consumers are important because they drive the need for the goods and services provided by businesses. Without the consumer, businesses and the government would not have way to generate revenue. Therefore, it's important for the consumer to have income that can be taxed and circulated back into businesses.

Hopefully, you can see how all these pieces fit together.

Where Are We Now?

Let's start with the linchpin of the economy … the consumers. Yes, the unemployment rate of 3.4% and increase of jobs is encouraging to the consumer. This is a positive sign they have a way to generate income - which ultimately flows to businesses through goods and services and the government via taxes. However, there are signs of increasing financial pressures for the consumer due to high inflation. There has been a rise in credit card debt and a decrease in people paying off their balances every month (See source).

To add to these financial pressures, there have been declines in Americans ability to save money. According to the Federal Reserve Bank of St. Louis, the personal savings rate for Americans fell to 3.3% in the third quarter of 2022. This is 88% lower than rates in 2020 when Americans were saving money at high rates, and 61% below the savings rates before the pandemic. (source)

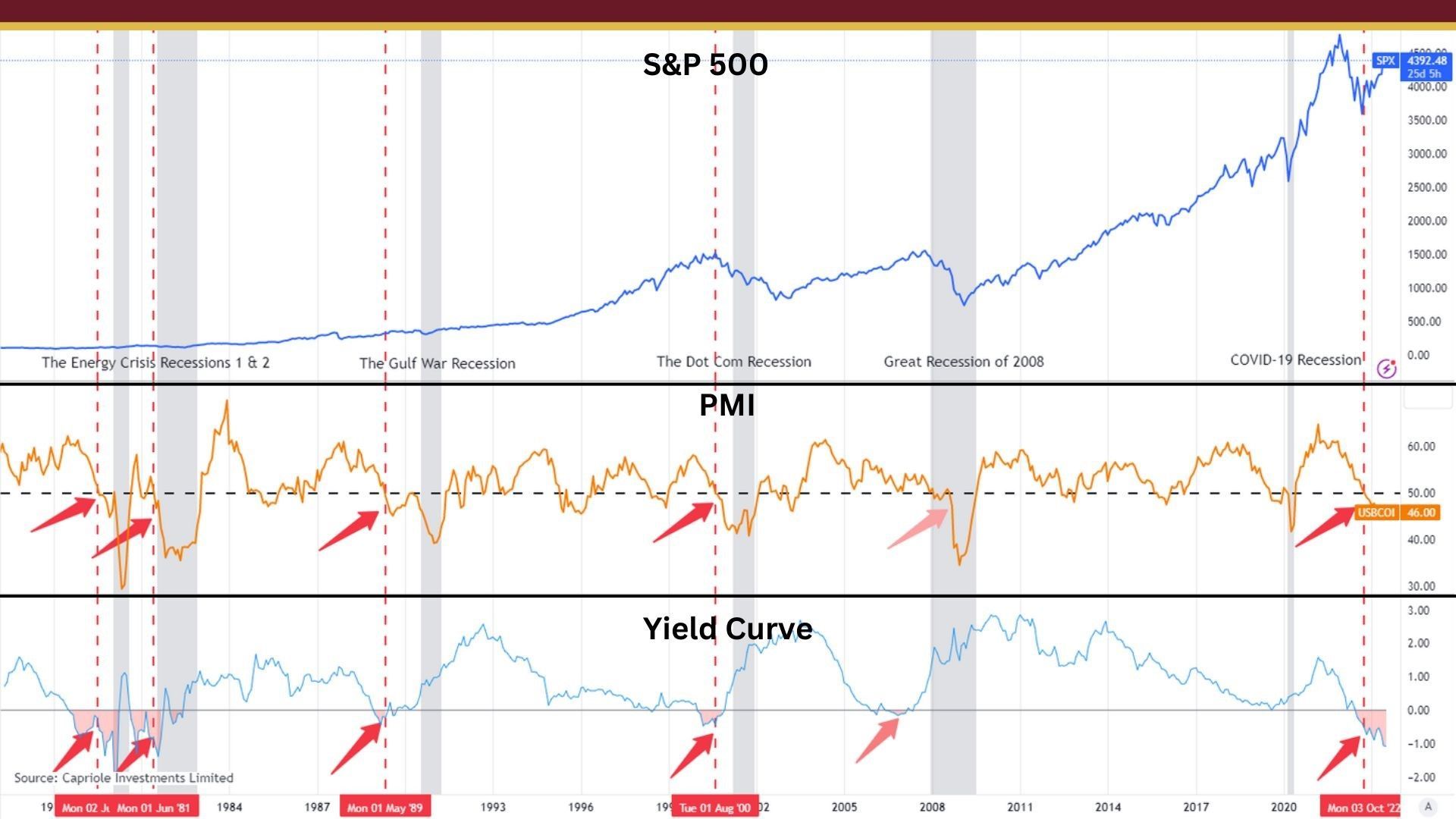

Businesses are also seeing a decline in their earnings. The companies that consist of the S&P 500 (the top 500 US publicly traded companies) have reported earnings decline of 3% or more for three straight quarters. (source). On top of these declines in earnings, many of the most well-known companies in the US have announced large layoffs. Some of these companies include Amazon, Microsoft, Disney, Google, Salesforce, IBM, and Goldman Sachs (Source).

Let's move to the US government. The US hit its $31.4 trillion debt ceiling on January 19, 2023. The debt ceiling was put in place to set a limit on how much debt the US could incur to cover its obligations. Any changes to the debt ceiling require majority approval by both chambers of Congress. (source). If congress cannot reach an agreement by June, economists warn that there could be dire consequences to the economy, including default. A default would mean that the federal government would have a difficult time serving the American people.

What's Next?

Despite the strong start to the market in 2023, in my opinion, all of these factors create tremendous headwinds for the Fed to navigate a soft landing during this economic slowdown. In fact, the leaders of large corporations may agree with me as they've been selling large amounts of shares into this rally to begin the year.

This can be tracked using the "insider buy/sell ratio". This ratio shows the balance between buys and sells for any officer, director, or person with 10% or more ownership in a publicly traded company. These high-level leaders are required to report the transactions they make on their company stock to prevent them from profiting from any inside information.

Since the beginning of the year, insiders have sold their company shares 4-6 times more than they have bought (See source). This could be a sign that they don't expect a lot of growth from their shares and are getting out while the market is up.

As of now, we believe the strong performance to start the year is a bull rally and anticipate a recessionary period in 2023 with a recovery in 2024. Until this conviction changes, our goal with Directional Portfolios is to stay the course with investments that have a history of outperforming in periods where inflation and economic growth decline simultaneously.

Schedule a Discovery Call

Schedule a Consultation

We will get back to you as soon as possible.

Please try again later.

VISIT US

Stop by and see us at the historic, Nowell-Wheeler House.

(Parking is available behind the building and along Williams Street)

248 North Broad Street

Monroe, GA 30655

CALL OR TEXT

EMAIL US

Abundance, LLC

678.884.8841 (Call or Text)

248 North Broad Street

Monroe, GA 30655

connect@findabundance.com

Securities offered through Kestra Investment Services, LLC, (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. Abundance is not affiliated with Kestra IS or Kestra AS.

Investor Disclosures: https://www.kestrafinancial.com/disclosures

This site is published for residents of the United States only. Registered Representatives of Kestra Investment Services, LLC and Investment Advisor Representative of Kestra Advisory Services, LLC, may only conduct business with residents of the states and jurisdictions in which they are properly registered. Therefore, a response to a request for information may be delayed. Not all of the products and services references on this site are available in every state and through every representative or advisor listed. Neither Kestra IS or Kestra AS provides legal or tax advice. For additional information, please contact our Compliance department at 844.553.7872.

Website by Faithworks Marketing